The Ethereum Merge & the tax implications for stakers

Ethereum is on the verge of merging from a “Proof of Work” to a “Proof of Stake” blockchain. This event, often referred to as “the merge”, is arguably the most significant event in crypto history since the inception of Bitcoin. The upgrade to the Ethereum blockchain has been in the works since 2016 and in last week’s Ethereum Consensus Layer Call it was suggested that the 19th of September 2022 will be the day Ethereum finally merges. With the historic date only a couple months away and the narrative dominating crypto headlines, we thought it was timely to provide a high level overview of the merge and highlight the tax implications of staking.

Proof of Work (PoW) vs Proof of Stake (PoS):

PoW and PoS are two different types of consensus mechanisms a blockchain can implement for its security, where validators (miners in the case of PoW and stakers in the case of PoS) may propose blocks, verify transactions and penalise malicious actors who attempt to disrupt the network.

Bitcoin, for example, is a PoW blockchain, meaning the network relies on the computational efforts of miners to validate transactions, which keeps the blockchain secure and decentralised. Miners require an investment in mining equipment that utilise significant amounts of energy to achieve the required computational output to verify transactions. For their efforts, miners are rewarded in Bitcoin, which is paid out from the blockchain’s transactions fees and supply issuance.

Since late 2020 Ethereum has been operating a PoS blockchain called the “Beacon Chain” alongside the main Ethereum PoW chain while it tests the PoS mechanism in preparation for when the Ethereum PoW chain eventually merges over to the Beacon PoS chain. Ethereum, under a PoS model, requires validators to commit (aka ‘stake’) capital in the form of the blockchain’s native token Ether (“ETH”) to the network in order to verify transactions. This is in contrast to requiring large amounts of energy and specialised computer hardware required under the PoW model to participate in securing the network. Validators are responsible for checking that new blocks propagated over the network are valid and occasionally creating and propagating new blocks themselves. As a reward, Ethereum validators are paid ETH from the transaction fees generated on the network and supply issuance which provides stakers with an approximate return on investment of 4%-6%. Should a validator act irresponsibly, the ETH staked by the validator is used as collateral which can be destroyed, known as a “slashing” event. Slashing exists to deter validators from acting maliciously against the network.

To find out how to participate in Ethereum staking, see this newsletter from Bankless that outline the various ways you can stake your ETH.

https://newsletter.banklesshq.com/p/how-to-stake-eth

The immediate impacts of the merge:

Reduction in issuance:

Moving to PoS allows Ethereum to reduce its annual supply of issuance paid to validators by approximately 90%. This is because the running costs of staking is a fraction of what it is as a miner (i.e. hardware and energy costs are almost eliminated) and therefore less ETH issuance is required to incentivise participation. To put this in perspective, the impact the merge will have on the reduction of ETH supply is the equivalent of 3 Bitcoin halvings. It is expected that the reduction in ETH’s supply issuance will result in ETH becoming a deflationary asset when combined with the Ethereum Improvement Proposal #1559 (“EIP1559”) which introduced a transaction fee burning mechanism that sees a portion of all transaction fees (that are paid in ETH) permanently removed from the supply. More on this here: https://youtu.be/oN1dozp3buQ?t=1680.

Network security:

Network security will be substantially increased when Ethereum moves to PoS. Expensive equipment (i.e. mining equipment) will no longer be required to participate in network validation, resulting in a greater number of total validators. More validators results in greater network security and decentralisation as it becomes increasingly difficult and expensive to attempt a 51% attack (a malicious attack where a bad actor attempts to take control of 51% of the validator nodes to rewrite the blockchain). While there are other blockchains that utilise a PoS consensus mechanism, many of them make considerable concessions on decentralisation.

Digital-native risk-free yield:

Cryptocurrency sceptics generally point to the absence of cash flows that flow back to investors of digital assets and, without cash flows, valuing these assets is near impossible and investment into these assets is more speculation than anything. This is by no means the case for Ether. Under PoS, Ether’s utility and monetary policy sees revenues flow directly to holders of Ether through its staking mechanism (comparable to a dividend). Many have likened this to the emergence of a digitally native bond with the Ether-staking relationship mirroring that of traditional bonds. The migration of Ethereum to PoS is turning Ether into the risk-free benchmark of the digital ecosystem.

ESG compliant:

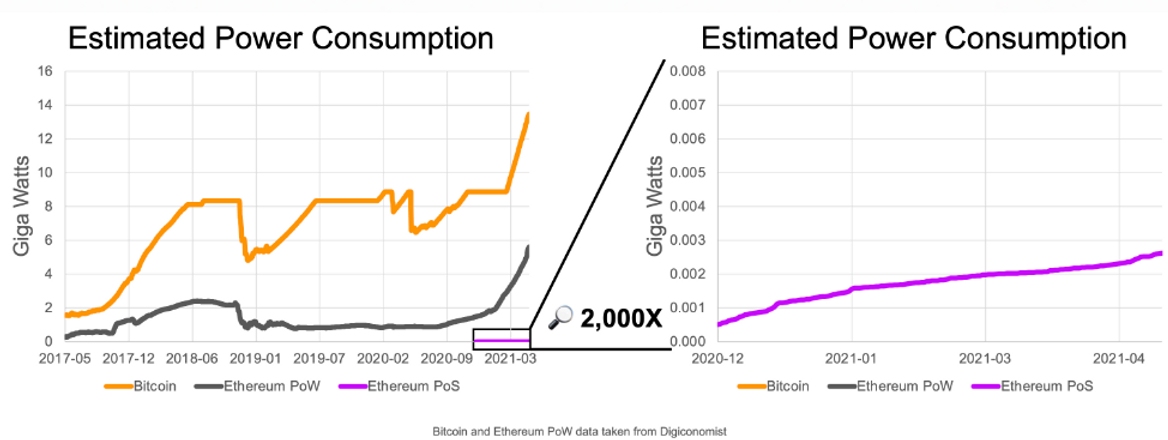

The merge will see Ethereum’s energy consumption fall by a staggering 99.95% as the network will now be secured by investors staking their assets rather than by miners running expensive and high energy consuming machines that will eventually convert to e‐waste. The investment appeal of the “green” crypto narrative should not be underestimated. It was only last year that Tesla ceased accepting Bitcoin as a payment method after pushback from investors and stakeholders over concerns of the excessive energy consumption by the Bitcoin blockchain. There are a significant amount of money managers who would like to allocate to crypto – (usually Bitcoin or Ether) but the proof-of-work consensus mechanism is

considered wasteful and violates their ESG mandates. PoS is ESG compliant and we expect that sentiment will shift drastically when Ethereum becomes the ESG‐friendly blockchain powering the future of finance.

Tax Implications of Staking

As crypto tax accountants we will of course cover the crypto tax implications of staking your digital assets. As you may have gathered from reading the above, staking is a common way for crypto investors to earn a passive yield on their investment, similar to earning interest on a bank deposit or receiving dividends. As such, the ATO’s current stance on staking is similar to how interest and dividends are treated for tax purposes, which means that any staking rewards received are viewed as ordinary income calculated at the market value at the time of receipt. The value of the rewards when received will form the cost base for the asset, and any deviation from the price the rewards were received at will result in a capital gain or loss at time of disposal. It is important to note that capital losses cannot offset ordinary income and therefore if a capital loss is realised when you sell your staking rewards, they cannot be used to offset the original income derived when those rewards were received.

Of course, the mechanisms of staking on one blockchain or protocol can be different to another so therefore we encourage you to get in touch with the crypto accountants at Tax On Chain to receive the right advice that is specific to your situation.

It takes a crypto tax accountant with specialist knowledge in blockchain and cryptocurrency to ensure you are meeting your reporting obligations. If you are unclear as to what your crypto tax obligations are, get in touch with our team of expert cryptocurrency accountants today.

Written by crypto tax accountants: Rafael Franco and Oliver Woodbridge